📌 E-Invoicing will be mandatory in Malaysia by 2026 — including for small businesses and masjids. Learn what it means, who’s affected, and how to stay compliant with AaraBookkeeping from just RM29.99/month.

[ads key="FRMTESLAZ1BT" enable_lazy_loading="no"][/ads]

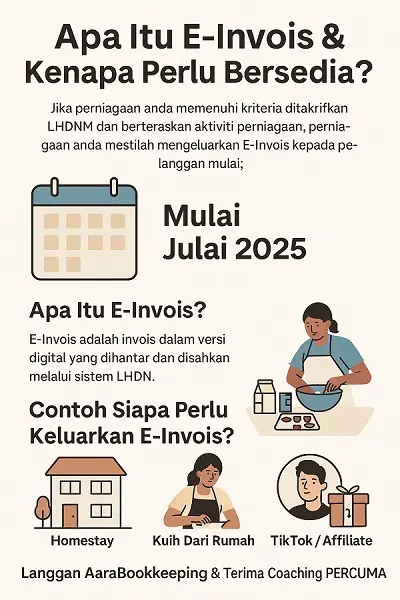

Malaysia is officially rolling out e-Invoicing in phases — starting with big corporations in 2024 and gradually reaching everyone else by 2027. It’s a major push for digitalisation and tax transparency… but let’s be honest, for small businesses and non-profit organisations like masjids, it feels more like a looming headache than an exciting upgrade.

If you’re running a small kedai, a food stall, a freelance gig, or even managing finances at a masjid, you’re probably wondering:

“Do I really need to worry about this?”

The short answer? Yes.

But don’t worry — there’s a smarter, simpler way to stay ahead of it.

💡 What Exactly Is E-Invoicing?

E-Invoicing in Malaysia means that every invoice — for a sale, service, donation, rental, or even refund — must go through LHDN’s MyInvois system for real-time validation.

It’s not just going paperless. It’s about syncing your invoicing activity with LHDN in a structured digital format — with less room for error, fraud, or lost records.

Sounds good in theory, right? But…

[ads key="NKZL7AWDCNU4" enable_lazy_loading="no"][/ads]

Arinara Homestay

Your Gateway to IOI City Mall and Putrajaya

🔔 Whether you’re issuing one invoice a month or a hundred, you’re still included.

😰 The Reality for Small Players

Big companies have the budget and IT departments to handle this.

But what about:

- A nasi lemak stall that makes RM1,500 a week?

- A small family-run business with RM400K in annual sales?

- A masjid collecting donations, hall rentals, or hosting community events?

These groups often don’t have access to complex systems or fancy software — nor do they have the time or know-how to figure it all out.

They just want a clean, easy way to send receipts or invoices, stay compliant, and move on with their day.

[categories-with-posts category_id_1="8"][/categories-with-posts]

📌 Who Needs to Comply?

Eventually, everyone — regardless of size or tax status.

✅ Businesses of all sizes

✅ Freelancers and self-employed professionals

✅ Non-profits that handle payments or issue receipts — including masjids collecting donations, renting halls, or receiving zakat

Even if you're not taxed, you might still need to issue a valid e-invoice if a donor or business partner asks for one. So, compliance isn't optional — it's just a matter of when.

[ads key="29BD5QBGSIYL" enable_lazy_loading="no"][/ads]

🛠️ What’s Actually Needed: A Simple E-Invoicing Tool That Works

Let’s keep it real — most current systems are:

❌ Too expensive

❌ Too complicated

❌ Not designed for phone users

❌ English-only or full of jargon

What small businesses and masjids really need is a tool that’s:

✅ Easy to set up (no finance degree required)

✅ Low-cost or free

✅ Mobile-friendly

✅ Integrated with LHDN’s MyInvois system

✅ Supportive of both Bahasa Malaysia and English

✅ Built for small-scale operations

This isn’t just about technology — it’s about accessibility and practicality.

[ads key="7VSETE3WFP8C" enable_lazy_loading="no"][/ads]

🕌 Why Masjids Should Start Paying Attention

Masjids may be non-profits, but they still handle money every day — whether it’s:

- Donations (with or without receipts)

- Hall or equipment rentals

- Sponsorships or event fees

These transactions may soon fall under e-Invoicing rules, especially if the payer requests an official, LHDN-compliant invoice.

Being proactive now means less scrambling later, and ensures transparency in managing the masjid’s finances.

[ads key="FRMTESLAZ1BT" enable_lazy_loading="no"][/ads]

✨ A Chance to Simplify, Not Complicate

Here’s the silver lining:

While e-Invoicing feels like one more thing to worry about, it’s also a golden opportunity to:

✔️ Clean up your records

✔️ Reduce manual paperwork

✔️ Avoid late-night Excel marathons

✔️ Stay transparent and trustworthy

But to make that happen, Malaysia doesn’t just need e-Invoicing systems. It needs simple, smart, and affordable ones — made for the little guys, not just the big corporations.

[ads key="OWBDLPGQIFMC" enable_lazy_loading="no"][/ads]

💬 Let’s Make It Easy for You

At AaraBookkeeping, we specialise in helping small businesses and non-profits (yes, including masjids!) get e-Invoice ready — without stress, confusion, or high costs.

We offer:

- Practical support in plain language

- Integration with e-Invoicing tools like SQL, AutoCount, or even Excel

- Localised help in both Bahasa and English

- And flexible plans that don’t break the bank

Whether you’re earning RM50K or RM500K, we’ll help you stay compliant, confident, and focused on what really matters — your business or your amal jariah.

E-Invoicing doesn’t have to be complicated. With the right support, it can be easy, affordable, and even empowering.

[ads key="NM0SDVKI7MYP" enable_lazy_loading="no"][/ads]

✅ E-Invoice Ready — Even If You Don’t See It in the Demo

Just a quick heads-up: if you're exploring the demo site, you might not see the e-invoicing feature enabled — and that’s intentional. E-invoicing integration requires a valid Tax Identification Number (TIN) or authorized API access tied to your business. That means the full functionality is only visible in live, registered accounts.

But rest assured — the system is fully e-invoice ready and built to meet LHDN’s compliance requirements the moment you’re set up.

💸 Starts at RM29.99/month — Cancel Anytime

One of the biggest wins for small businesses? The pricing.

AaraBookkeeping plans start at just RM29.99/month, with no long-term contracts and the flexibility to cancel anytime. Whether you’re testing things out or going all in, this is an affordable way to stay compliant without burning your budget.

And it’s not just e-invoicing. The platform is built on double-entry bookkeeping standards, giving you accurate, LHDN-aligned records — so your finances are not only organised, but fully audit-ready.

You get full access to a localised, support-driven system — without the complexity or cost of enterprise tools.

[ads key="AOK6LKVWT5R5" enable_lazy_loading="no"][/ads]

⏳ Final Reminder: E-Invoicing Is Mandatory for Everyone by 31 Dec 2025

📅 By 31 December 2025, every business in Malaysia — including those with annual revenue under RM500,000 — must be ready to e-invoice.

🚨 LHDN enforcement kicks in from 1 January 2026.

No exceptions. No delays. If you issue invoices, you must be compliant.

The earlier you prepare, the smoother the transition. Don’t wait until it’s a last-minute scramble.

[ads key="29BD5QBGSIYL" enable_lazy_loading="no"][/ads]

🚀 Let’s Make Compliance Simple

With AaraBookkeeping, you're not just getting a tool — you're getting a team that understands small business needs in Malaysia. We'll help you get e-invoice ready, stay compliant, and keep your books stress-free.

👉 Book your free consultation today

Get ahead now — and avoid the year-end rush later.

💬 Interested?

Please send your feedback or questions to:

📧 Bookkeeper1705@gmail.com

Comments (3)

* * * Zero investment Real payout Try it now: http

4 months ago72rzdu

Reply Comment

* * * <a href="https://presswirenetwork.com/index.

4 months ago72rzdu

Reply Comment

Woodrowthurb

2 months agoThis morning played at <a href=https://telegra.ph/Stake-Casino-Australia-2025-Navigating-the-Crypto-Gambling-Landscape-Down-Under-10-13-7>Follow here to explore Stake’s wide selection of casino games available for Australian users</a> — real win, no scam. No ID, easy withdrawal. Big win today. From Melbourne to Brisbane.

Reply Comment